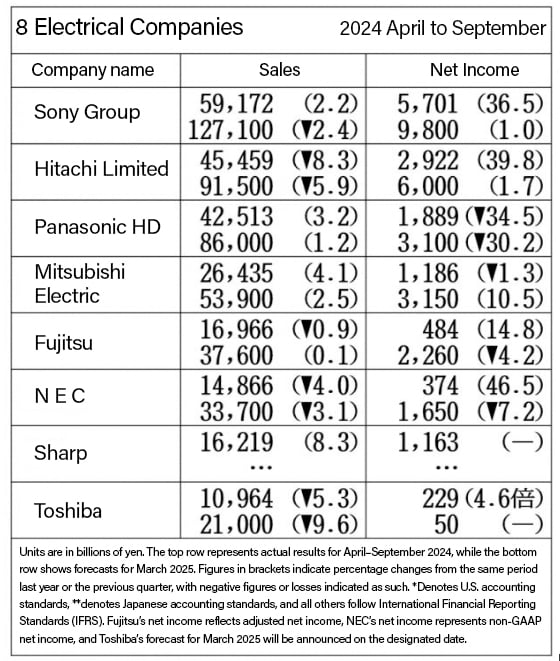

Electronics Industry Booms: 8 Major Companies Raise Full-Year Revenue Targets Amid Growing Digital Transformation Investments

Eight major electronics companies revised their full-year revenue forecasts upward, driven by strong core businesses and increasing global demand for digital transformation (DX). However, risks remain due to rising geopolitical tensions, including U.S.-China trade frictions. Sony and Hitachi lead the way, with other firms showing mixed results.

15 November 2024 - Eight major electronics companies have released their consolidated earnings forecasts for the fiscal year ending March 2025. Among them, the Sony Group revised its sales forecast upward, and Hitachi increased both sales and adjusted operating profit due to the strength of their core businesses. However, Fujitsu revised its operating profit forecast downward, citing increased early retirement benefits. In the second half (October to March 2025), growth is anticipated, driven by rising domestic and international electricity demand and sustained investment in digital transformation (DX). Nevertheless, geopolitical risks, including potential trade friction between the U.S. and China following the U.S. presidential election, remain a concern.

Sony Group raised its sales forecast by 100 billion yen, driven by growth in the gaming sector. However, it lowered its forecast for the image sensor sector due to a decline in sales volumes for mobile device sensors. Sony President Hiroki Toki commented, “The United States significantly impacts the global economy and geopolitics. We aim to thoroughly analyze the situation and anticipate future developments,” adding that the company plans to clarify its manufacturing and shipping strategies and address price adjustments.

Hitachi revised its forecast upwards due to strong performance in its U.S. and European power transmission and distribution business for data centers, along with increased digital investment in Japan. Andreas Schierenbeck, CEO of Hitachi Energy, expressed confidence, stating, “Investments in power transmission and distribution networks by power companies and other sectors will continue for 10 to 20 years.”

Panasonic Holdings (HD) maintained its full-year forecast. In the April–September 2024 period, sales and operating profits grew, supported by strong performance in welding machines, semiconductor mounting machines, and materials for AI servers.

Mitsubishi Electric also maintained its full-year forecast. While its factory automation (FA) business forecast was revised downward, the social and power systems business forecast was revised upward due to a broad increase in electricity demand.

Fujitsu reported its highest-ever adjusted operating profit for the April–September 2024 period. Although hardware sales struggled due to the weak yen, Executive Vice President Takeshi Isobe highlighted robust growth in its core service business, fueled by domestic demand.

Takeshi Isobe highlighted robust growth in its core service business, fueled by domestic demand.

NEC’s operating profit grew during the same period, supported by a favorable order environment for IT services driven by strong domestic demand for digital transformation. The social infrastructure sector also performed steadily due to cost efficiency improvements in telecommunications services and favorable aerospace and defense results.

Sharp returned to profitability in operating profit for the April–September period, reporting a 400 million yen profit compared to a 5.8 billion yen loss in the same period last year. This turnaround was attributed to cost reductions in the LCD panel business and strong sales of multifunction copiers and PCs.

Toshiba announced a profit of 116.3 billion yen for the April–September period, compared to a 52.1 billion yen loss in the same period last year. This performance was bolstered by strength in the power transmission and distribution and DC hard disk drive (HDD) businesses, as well as improved results from Kioxia HD, a major semiconductor company accounted for under the equity method. Operating profit surged to 70.5 billion yen, more than tripling from the same period last year.

Vice President Mitsuji Ikeya emphasized that the improvement stemmed not only from external factors such as market conditions and exchange rates but also from “self-help efforts like price adjustments and the review of unprofitable projects.” Toshiba, undergoing management restructuring after delisting, has not disclosed its earnings forecast for the fiscal year ending March 2025.

#electronics #industry #businessperformance #Mreport #ข่าวอุตสาหกรรม

Source: Nikkan Kogyo Shimbun